Checkout Terminal

Checkout Terminal

Checkout Terminal is the solution for processing written or telephone order payment data. Payment details of the consumers are recorded in the web-based, password-protected interface and are processed automatically and immediately during the telephone order process. All successful transactions are available in the Payment Center.

Here is a demo access for testing purposes.

Using Checkout Terminal

| Field name | Optional or required | Maximum field length | Description |

|---|---|---|---|

Company |

Optional

|

Alphanumeric, up to 60 characters. |

Name of company ordering the relevant items (products). |

First and last name |

Optional

|

Alphanumeric, up to 20 characters for the first name and 25 characters for the last name. |

Consumer’s first and last name. |

Address |

Optional

|

Alphanumeric, up to 100 characters. |

Consumer’s address. |

Order reference |

Optional

|

Alphanumeric, up to 128 characters, differs depending on the payment method used. |

Unique order reference ID sent from merchant to financial service provider. |

Comment |

Optional

|

Alphanumeric, up to 255 characters. |

Additional data relating to the order, e.g. invoice number or purchase number. |

Amount |

Required

|

Alphanumeric, up to 10 characters. |

Payment to be effected by consumer. |

Currency |

Required

|

Alphabetic or numeric, fixed 3 characters |

Currency code of amount. |

Payment method |

Required

|

Selection field. |

Payment method used for the transaction: Credit Card, SEPA Direct Debit or recurring payment. |

| Data | Value |

|---|---|

Field name |

Company |

Optional or required |

Optional |

Maximum field length |

Alphanumeric, up to 60 characters. |

Description |

Name of company ordering the relevant items (products). |

Data |

Value |

Field name |

First and last name |

Optional or required |

Optional |

Maximum field length |

Alphanumeric, up to 20 characters for the first name and 25 characters for the last name. |

Description |

Consumer’s first and last name. |

Data |

Value |

Field name |

Address |

Optional or required |

Optional |

Maximum field length |

Alphanumeric, up to 100 characters. |

Description |

Consumer’s address. |

Data |

Value |

Field name |

Order reference |

Optional or required |

Optional |

Maximum field length |

Alphanumeric, up to 128 characters, differs depending on the payment method used. |

Description |

Unique order reference ID sent from merchant to financial service provider. |

Data |

Value |

Field name |

Comment |

Optional or required |

Optional |

Maximum field length |

Alphanumeric, up to 255 characters. |

Description |

Additional data relating to the order, e.g. invoice number or purchase number. |

Data |

Value |

Field name |

Amount |

Optional or required |

Required |

Maximum field length |

Alphanumeric, up to 10 characters. |

Description |

Payment to be effected by a consumer. |

Data |

Value |

Field name |

Currency |

Optional or required |

Required |

Maximum field length |

Alphabetic or numeric, fixed 3 characters. |

Description |

Currency code of amount. |

Data |

Value |

Field name |

Payment method |

Optional or required |

Required |

Maximum field length |

Selection field. |

Description |

Payment method used for the transaction: Credit Card, SEPA Direct Debit or recurring payment. |

| Depending on the specific requirements and the configuration settings, the number of fields and the field length and characteristics may differ, so if the maximum character length is exceeded, any additional characters are ignored. |

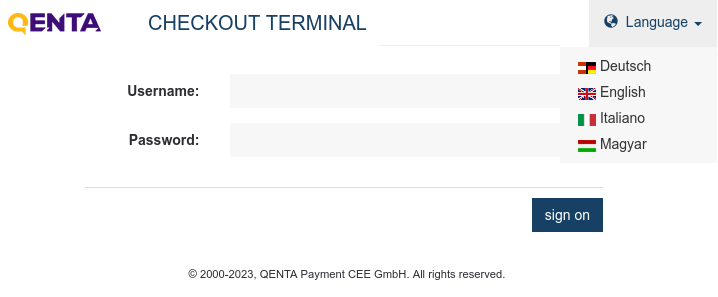

Logging in to the Checkout Terminal interface

The login can be found at the following link.

-

The username and password must be entered.

-

When the login was successful, a summary of the login data is displayed.

| After the first login, a new password must be set. |

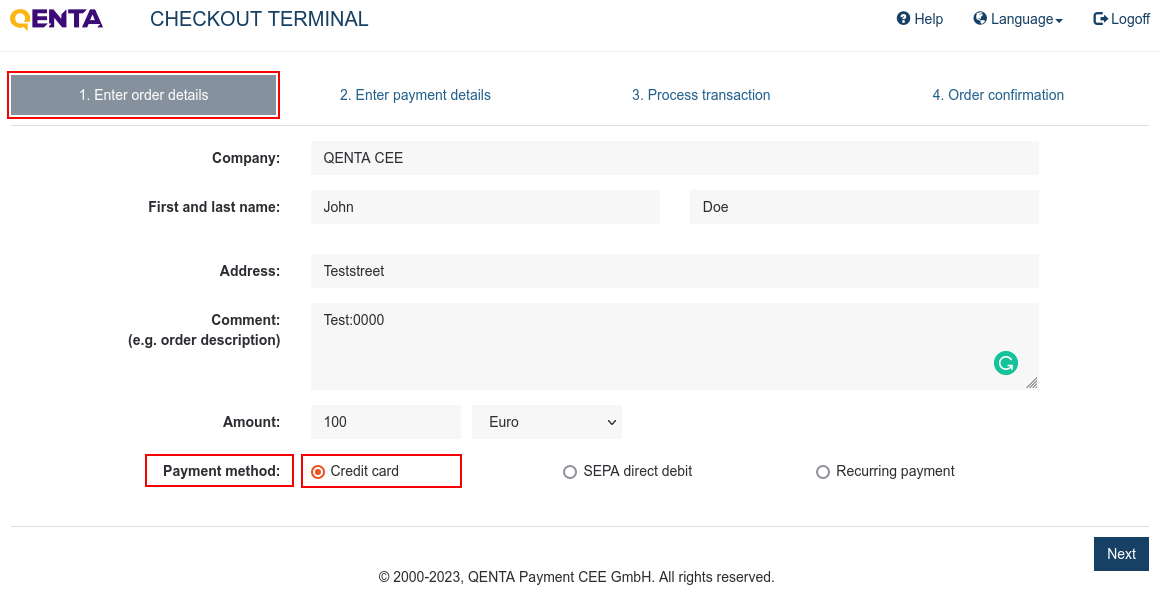

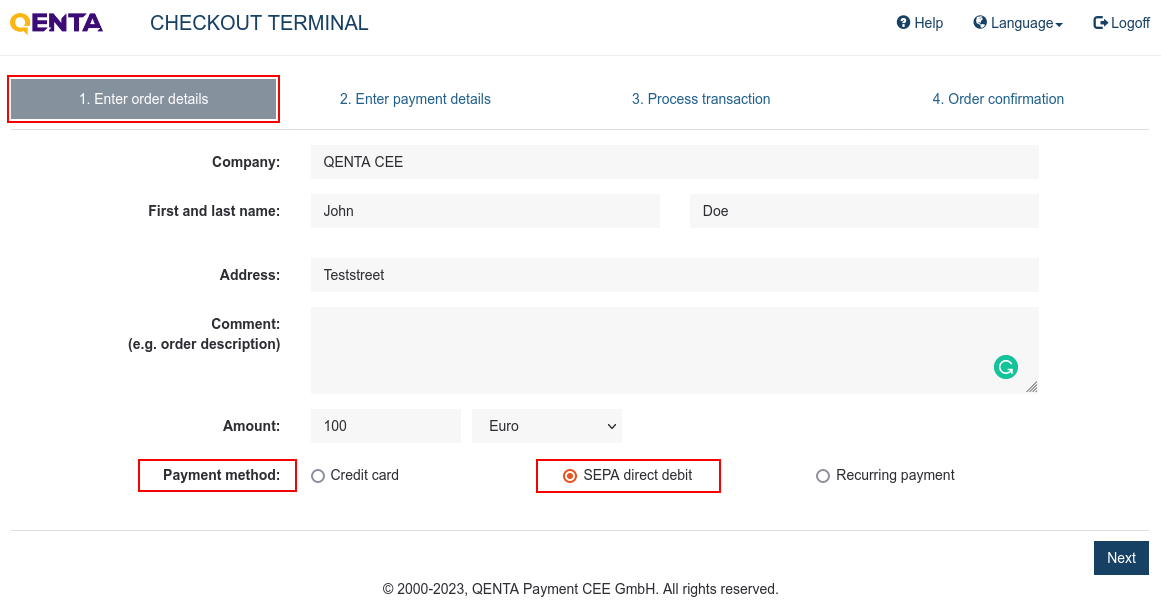

Completing payment with Credit Card

Steps for carrying out a payment using Credit Card.

Step 1

Order details:

-

After completing the fields the merchant selects payment method > Credit Card.

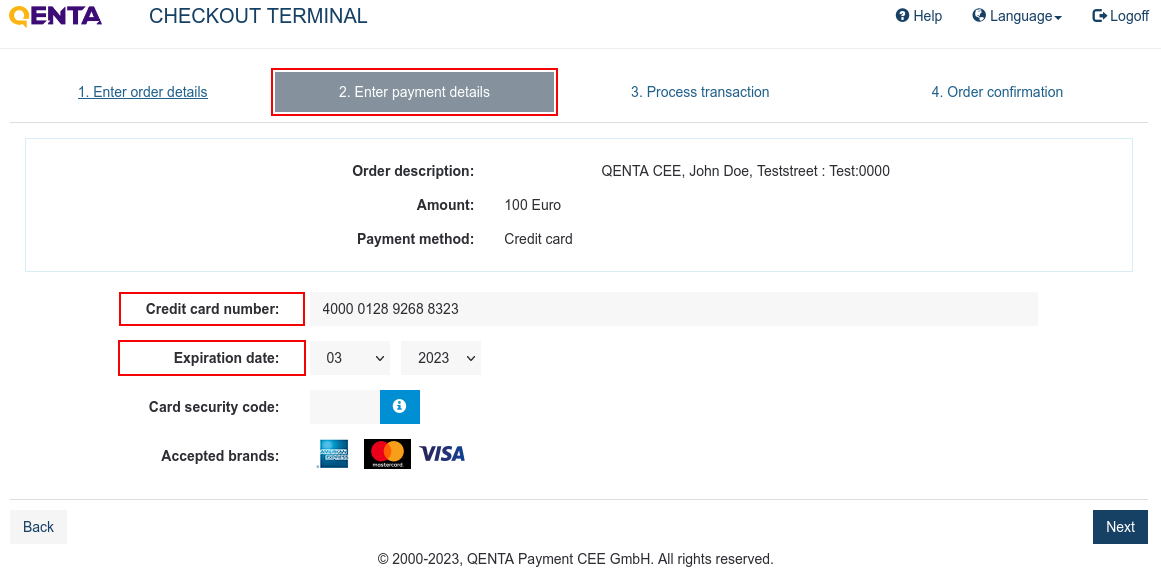

Step 2

Payment details:

-

The consumer’s credit card details: credit card number and expiration date (the card security code is not necessary).

-

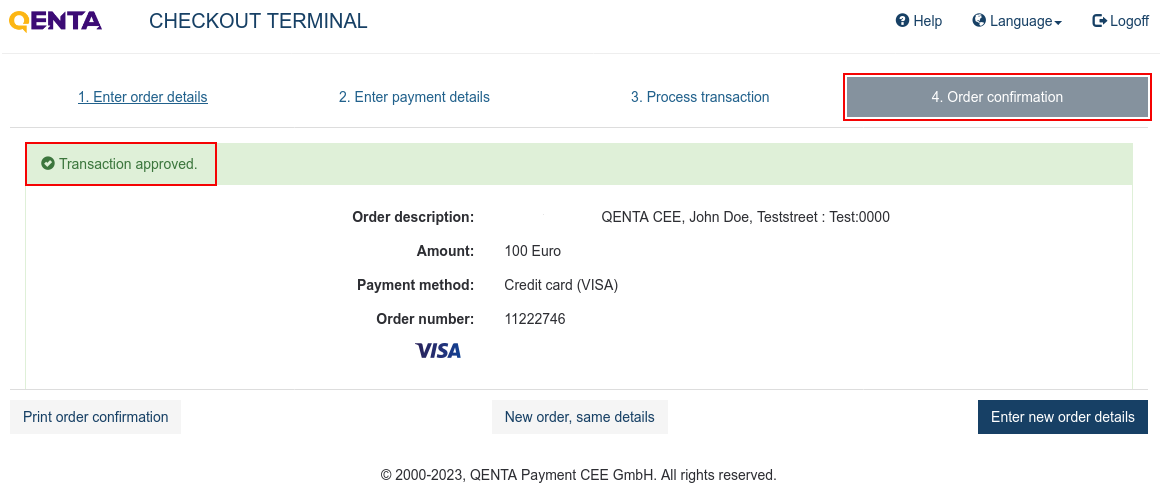

If the payment has been completed successfully, the message Transaction approved appears.

If the credit card payment has been successfully processed, approval for the payment amount is displayed in the Payment Center. But completed payments are not automatically deposited via Checkout Terminal, so to receive the outstanding amounts the approved amounts need to be deposited in the Payment Center.

hobex Service IT carries out the deposit of approved payments and there are two configuration options:

-

Daily fully automated deposit of all payments-all payments are deposited once during the night.

-

Immediate capture-after affecting a payment, the payment is available immediately as a capture.

| Not deposited approvals will expire after 7-14 calendar days and after exceeding the individual deadline these payments can no longer be submitted or received. |

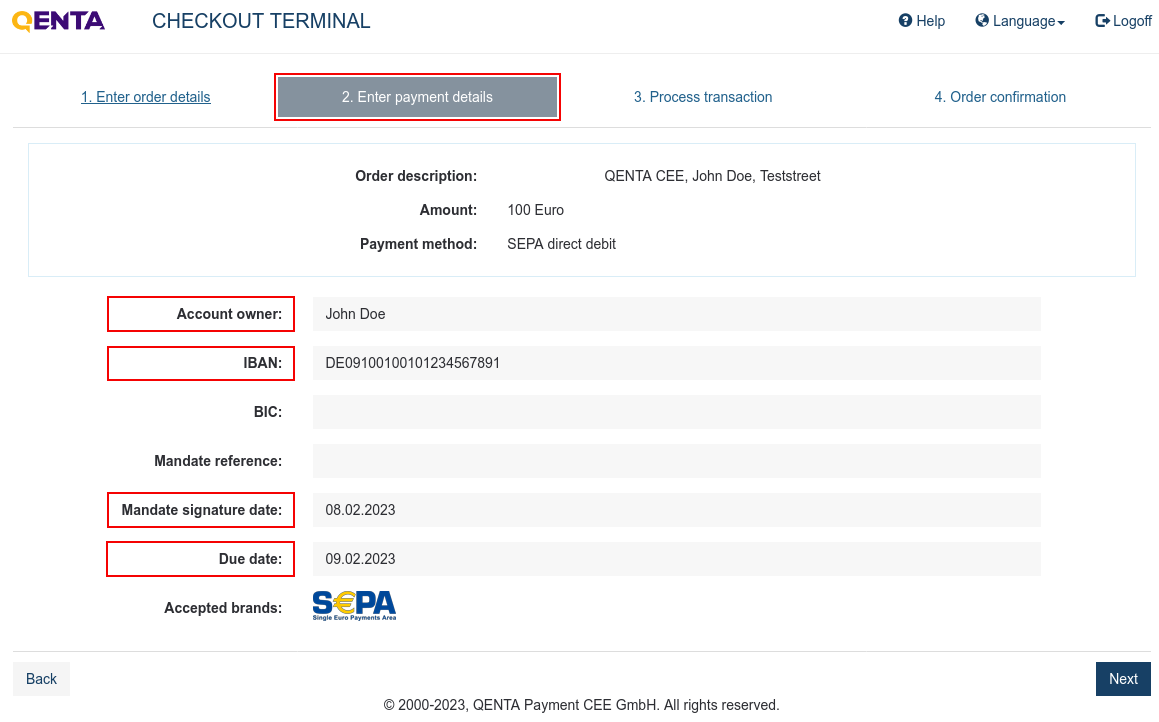

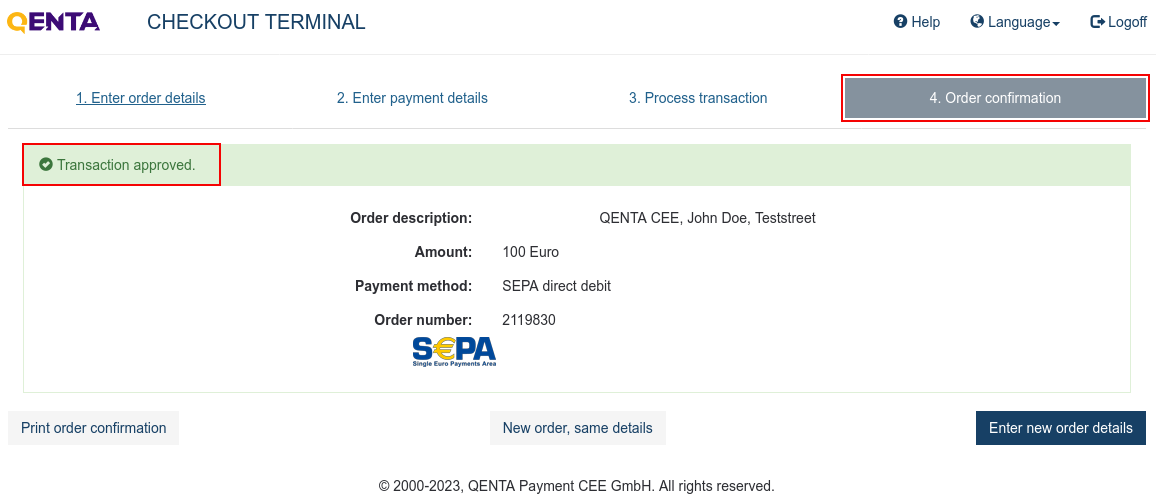

Completing payment with SEPA Direct Debit

Steps for carrying out a payment using SEPA Direct Debit.

Step 1

Order details:

-

After completing the fields the merchant selects payment method > SEPA Direct Debit.

Step 2

Payment details:

-

The consumer’s bank details: account owner, IBAN, BIC,mandate reference, mandate signature date and due date.

-

If the payment has been completed successfully, the message "Transaction approved" appears in the window that opens Order confirmation.

-

At the same time, a unique order number is created automatically.

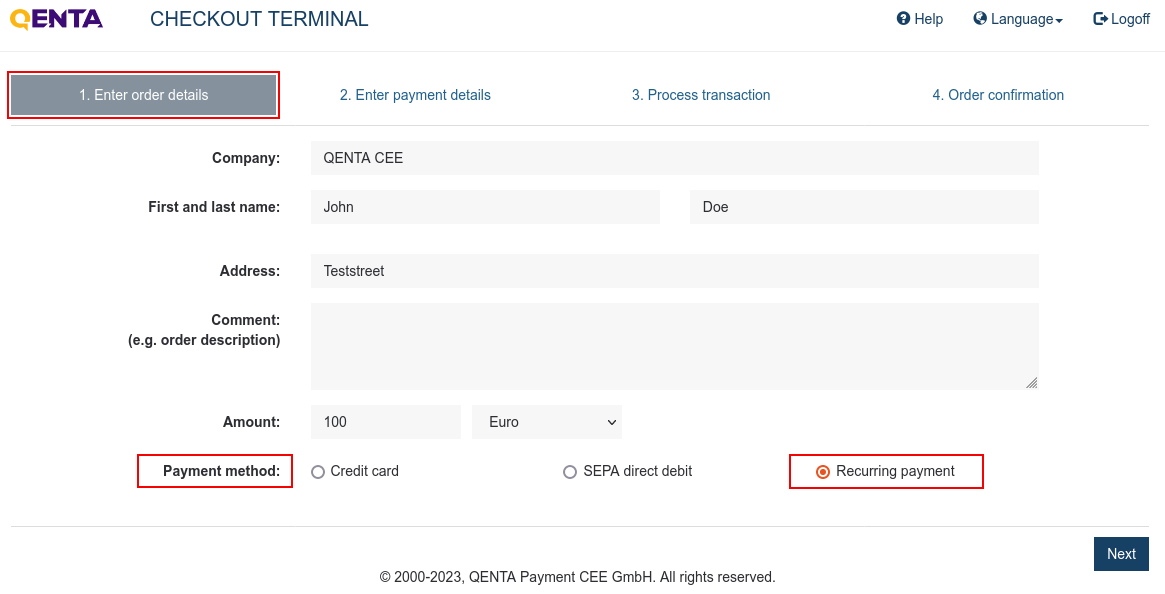

Effecting a recurring payment

Steps for recurring payment:

Step 1

Order details:

-

After completing the fields the merchant selects payment method > Recurring payment.

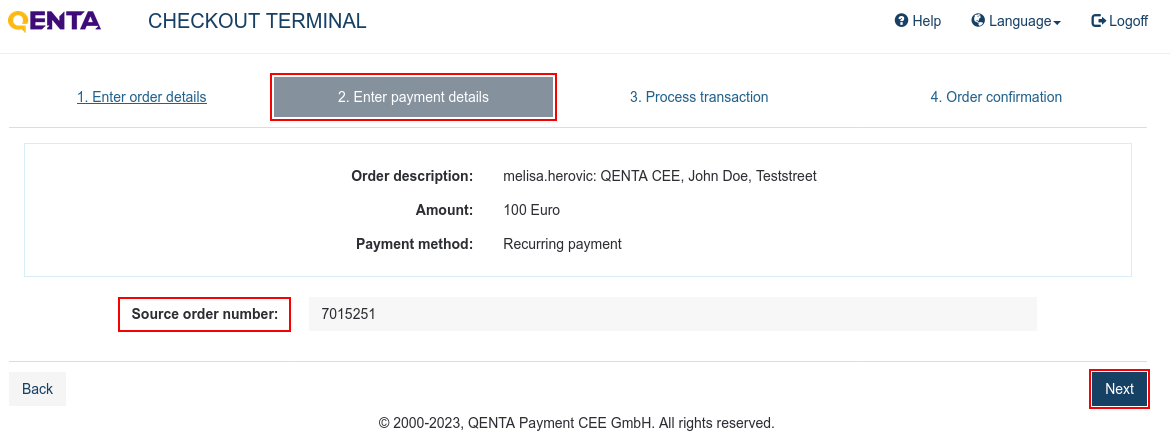

Step 2

Payment details:

Recurring payment details:

-

Source order number: original order number. Enter the order number to which the recurring payment refers.

-

A window opens and shows a summary of the source order data > Next.

-

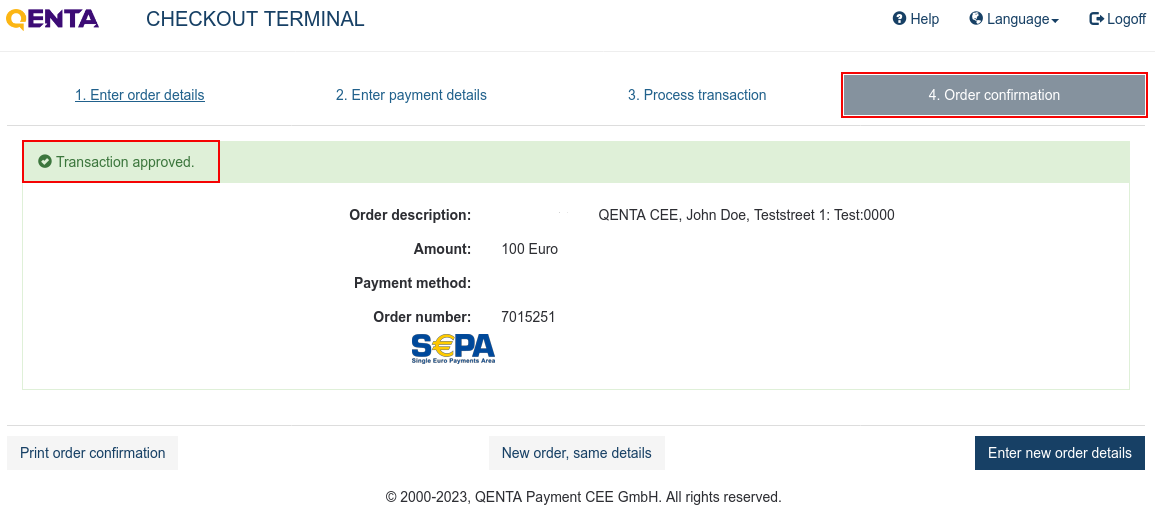

If the payment has been completed successfully, the message Transaction approved appears in the window Order confirmation.

-

At the same time, a unique order number is issued automatically.

| Generally, payment for the source order number must not be older than 400 days for credit card payments. If the order is older than 400 days, the error message "Card number missing" is displayed. If the expiration date of the credit card of the stored source order was exceeded, the error message "Expiration date is invalid" is displayed. In both error cases, obtain the new credit card details from the consumer and initiate a new order since a recurring payment may not be carried out. |

There are currently no restrictions on payments using SEPA Direct Debit procedures.